The pharmaceutical industry is a complex network, with Active Pharmaceutical Ingredients (API) at its core. API Pharma represents a vital segment, responsible for producing the essential components of medications. According to a report by Mordor Intelligence, the global API market is projected to exceed $290 billion by 2027. This significant growth highlights the increasing demand for pharmaceuticals worldwide.

API Pharma plays a crucial role in drug formulation and affects overall therapeutic efficacy. It influences drug safety and patient outcomes directly. However, challenges persist. Quality control and regulatory compliance are ongoing concerns in API production. A study from ResearchAndMarkets indicates that about 30% of pharmaceutical companies faced issues with API quality in 2021. This situation emphasizes the need for continual improvement in manufacturing practices.

Investors and stakeholders must also acknowledge the competitive landscape. Countries like India and China dominate API manufacturing, leading to pricing pressures. Innovation in API technologies is essential for companies striving to maintain market share. Therefore, a thoughtful approach to API Pharma is necessary, balancing efficiency, safety, and ethical considerations in this ever-evolving sector.

Active Pharmaceutical Ingredients (APIs) are critical components in medicines. They are the biologically active parts that provide therapeutic effects. The global API market is anticipated to reach USD 260 billion by 2026, as per a recent market report. This growth reflects the increasing demand for effective pharmaceuticals.

APIs can be natural or synthetic. They undergo rigorous testing and regulations to ensure their safety and efficacy. In fact, over 25% of new drugs fail due to API-related issues. This highlights the importance of stringent quality control in the production process. Companies must invest in advanced technologies to ensure compliance with global standards.

Tip: Always research the origin and manufacturing processes of APIs. Understanding these factors can help you choose better medications.

A potential drawback in the API market is the reliance on a few geographical regions for production. For instance, around 40% of APIs are sourced from India and China. This reliance can create vulnerabilities in the supply chain, especially during global disruptions. Companies should consider diversifying their suppliers to mitigate such risks.

Tip: Keep an eye on regional trends in API manufacturing. It can affect product availability and pricing.

The chart above illustrates the importance of various dimensions of API Pharma within the pharmaceutical industry. Active Pharmaceutical Ingredient production, Regulatory Compliance, and Market Demand are crucial areas that impact overall industry performance, alongside Research & Development and Cost Efficiency.

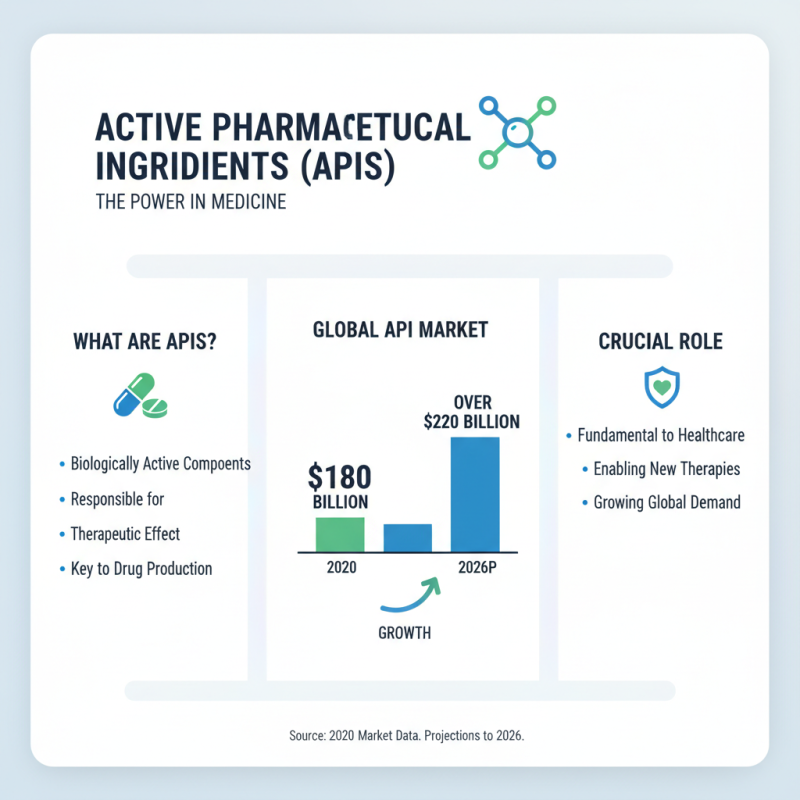

Active Pharmaceutical Ingredients (APIs) are fundamental to drug production. They are the biologically active components in medicines, responsible for the therapeutic effect. In 2020, the global API market was valued at approximately $180 billion, with projections to reach over $220 billion by 2026. This growth highlights the crucial role APIs play in the pharmaceutical landscape.

The quality and availability of APIs directly affect drug efficacy. However, the industry faces challenges. Supply chain disruptions can lead to shortages. For instance, recent reports indicated that about 40% of pharmaceutical companies experienced API sourcing issues. This emphasizes a lack of resilience in the supply chain. Diversification of sources could be a potential solution, yet many companies remain reluctant to change their established networks.

Sustainability is also an emerging concern. The production of APIs often involves significant environmental impacts. Companies must reflect on their processes to become more eco-friendly. The demand for greener manufacturing methods is increasing. Recent surveys indicate that 70% of industry professionals see the need for sustainable practices. These reflections are vital for balancing quality, accessibility, and environmental responsibility in API production.

Active Pharmaceutical Ingredients (APIs) form the backbone of drug development. They are the substances responsible for the intended medicinal effects. In the pharmaceutical industry, APIs are critical. They are involved in every stage of medication processing. From initial research to final production, APIs play a key role.

The process of developing APIs is complex. It demands advanced technology and strict regulations. Manufacturers must ensure that APIs meet quality standards. Contamination can happen easily. Small errors in production can lead to major health risks. This emphasizes the importance of quality control in the manufacturing process. While progress has been made, challenges still exist.

The journey from lab to market involves numerous steps. Each phase has its hurdles. Collaboration among scientists, manufacturers, and regulatory bodies is essential. They must work together to ensure safety and efficacy. However, industry pressures can lead to oversight. This relationship can be challenging and requires constant reflection to improve practices. The pharmaceutical industry must stay vigilant to maintain public trust and health.

Active Pharmaceutical Ingredients (APIs) are crucial in the pharmaceutical sector. They are the primary substances responsible for the therapeutic effects of medications. The production of APIs is tightly regulated, ensuring quality and safety. According to the International Pharmaceutical Federation (FIP), around 70% of drug development costs are linked to API production. This highlights the importance of adhering to regulatory standards.

Regulatory bodies like the FDA and EMA establish guidelines for API manufacturing. These standards cover Good Manufacturing Practices (GMP), which ensure uniform quality. A report from the Global API Market states that the global API market size was valued at $209.9 billion in 2021, emphasizing the vital role of strict regulations. Companies often face challenges in meeting these standards, leading to delays in drug approvals and market entry.

Tips: Stay informed about regulatory updates. These can change frequently, impacting the API landscape. Conduct regular audits of manufacturing processes. This can ensure compliance and prevent costly issues. Engage in continuous training for staff. Well-informed employees can better navigate complex regulations. Remember, meeting these standards is not just a checkbox; it is the foundation of safe healthcare products.

The API (Active Pharmaceutical Ingredient) pharma sector is evolving rapidly. As global health demands rise, the need for innovative APIs becomes crucial. Companies are exploring sustainable practices and eco-friendly production methods. This trend reflects a shift towards minimizing environmental impact. Many firms are investing in greener technologies. However, challenges remain in balancing cost and sustainability.

Digital transformation is another significant trend. Automation and artificial intelligence are streamlining production processes. These technologies can enhance efficiency, but they also require ongoing investment. The transition isn’t always smooth. Some companies struggle to adopt these innovations fully. They face technical hurdles and workforce training issues.

Regulatory changes are influencing the API landscape as well. Stricter guidelines aim to ensure quality and safety. Compliance can be burdensome for manufacturers. Yet, it heightens trust among consumers. Continuous adaptation is vital in this fast-paced environment. The API sector must stay agile to meet future demands and challenges.

| Dimension | Current Status | Future Trends |

|---|---|---|

| Market Size (USD Billion) | 150 | 200 by 2025 |

| Major Regions | North America, Europe, Asia | Emerging Markets growth |

| Key Drivers | Increased R&D, Regulatory changes | Personalized Medicine, Biologics |

| Challenges | Cost Management, Compliance | Sustainability, Supply Chain Disruptions |

| Investment Trends | Mergers and Acquisitions | Increased Venture Capital |